Bankruptcy Act vs Chapter 11: The US Wins in Corporate Restructuring

THE ITALIAN PROCESS IS LONGER, MORE EXPENSIVE AND LEADS TO A LOWER RATE OF DEBT COLLECTION, ACCORDING TO AN ANALYSIS BY THE SDA BOCCONI RESEARCH DIVISION, COORDINATED BY MAURIZIO DALLOCCHIOItalian companies enter into restructuring procedures when they are still in better health compared to US companies using Chapter 11. In the United States, however the procedure is not only less expensive, it is also faster and leads to a result that is noticeably better in terms of debt collection. These are the results from the latest study completed by the Claudio Dematté Research Division at the SDA Bocconi School of Management in collaboration with EY, presented this morning at the conference Taking Stock of the Crisis After Eight Years: Research, Business and Finance Compared.

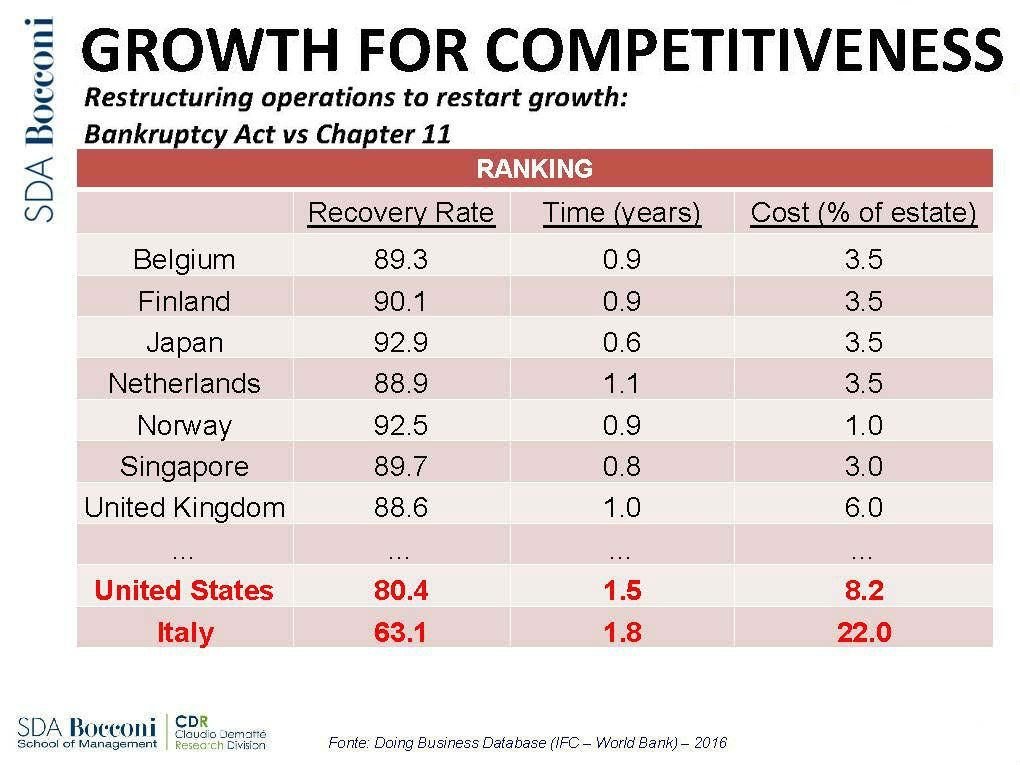

Small Italian firms face restructuring procedures with a leverage ratio of 0.88, against 1.11 for small US firms, while values for large firms are equal to 0.83 for Italy and 1.07 for the United States. Then, a procedure begins that lasts 1.5 years in the United States and almost one year and ten months in Italy. More significantly, in Italy the cost is 22% of net equity, while in the United States it is only 8.2%. All this translates into a recovery rate that, in Italy, is only 63.1%, while it is 80.4% in the United States.

The comparison completed by SDA Bocconi also includes Belgium, Finland, Japan, the Netherlands, Norway, Singapore and the UK. The Italian procedure showed the worst results in all three parameters (recovery rate, time and cost).

The data on Italian firms that emerge from the research, coordinated by Maurizio Dallocchio for SDA Bocconi and experts in the area of TAS - Transaction Advisory Services at EY Italia, confirm a deficiency in capitalization that afflicts the national economy. The financing structure of companies is, in fact, characterized by a strong recourse to short-term loans and commercial debt (deferment of payments), which together make up 45% of financing sources.

“If Italian firms want to restart growth, they must go full throttle in terms of mergers and acquisitions and seek out forms of financing other than bank debt,” said Dallocchio. “Larger sizes offer increased capacity for exports, innovation, learning and cost control. But also a variety of financing sources, starting with debentures, which are not available to smaller firms. Larger firms are also less exposed to the winds of crisis and less prone to ending up in illiquidity.”

“Over recent years, the interest of foreign investors in the Italian market has clearly increased,” added Enrico Silva, head of the Private Equity sector for EY for the Mediterranean area. “A fundamental indicator can be derived from the growth of Italian private equity fundraising with foreign investors, which increased from €165mln in 2013 to €1.2bln in 2015, and in particular from the growth of direct investments by international operators, which grew from €1.4bln to €3.2bln during the same period. In addition, Italian firms have a varied and flexible offer of choices in forms of financing, ranging from pure private equity to private debt to hybrid equity/debt instruments. The latter, however, still represents a marginal segment of the market with a little over €150mln invested in 2015. Very often the main problem for Italian firms is an inadequate understanding of these instruments, which are much more developed in Anglo-Saxon markets.”

by Fabio Todesco

Translated by Jenna Walker