Liquidity Risk Dries Long Term Credit and Hampers Investments

EVERY RAMADAN, PAKISTANI BANKS ARE SUBJECT TO VIOLENT WITHDRAWAL AND REDEPOSIT CYCLES DUE TO THE WAY A LEVY IS CALCULATED. NICOLA LIMODIO OBSERVED WHAT THIS MEANS FOR CREDIT SUPPLYIn low-income countries, banks are the primary drivers of long-term finance but they are also responsible for its scarcity. Bocconi Professor Nicola Limodio and his co-author Ali Choudhary, in a paper published online in advance by the Review of Economic Studies, showed that this is partly due to liquidity risk and that, furthermore, it limits both long- and short-term investments.

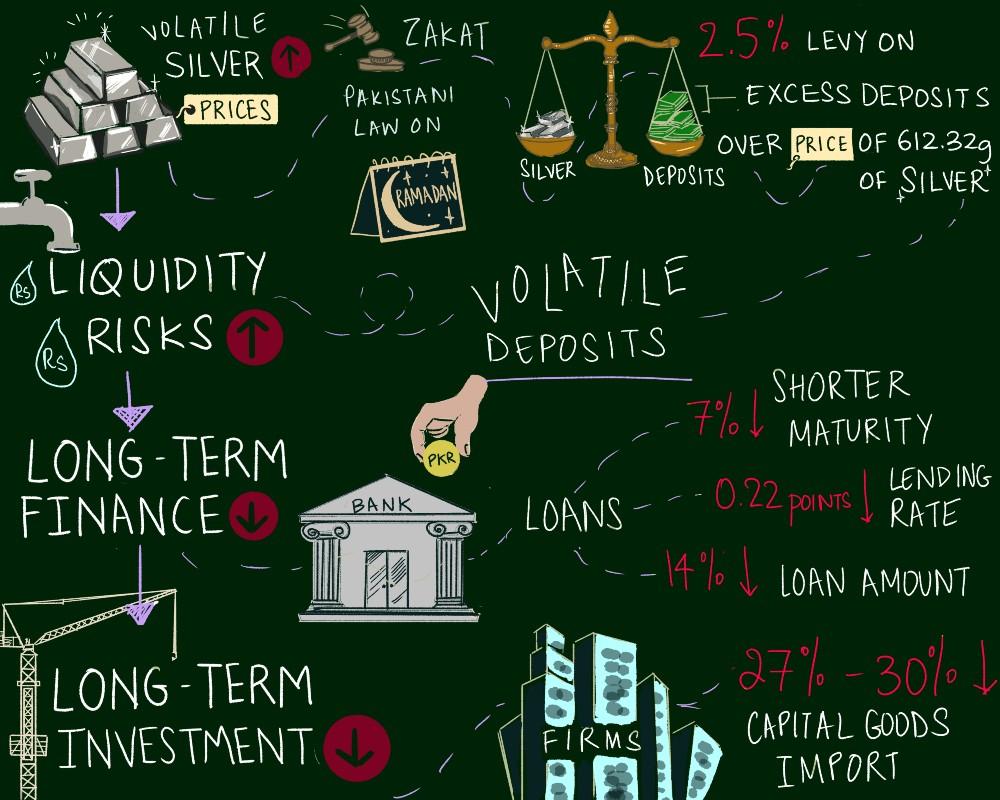

In order to show that liquidity risk impacts the supply of a bank’s long-term finance but not the firms’ demand for long-term finance, the authors leveraged a Pakistani law applied to Sunni Pakistanis – the Zakat.

Under this law, every Ramadan, the Pakistani government collects a Sharia-compliant levy of 2.5% on bank deposits that exceed a specific deposit threshold. Importantly, this threshold is not fixed, but it is determined by the current monetary value of 612.32 grams of silver. This value is unrelated to firms’ demand for long-term finance, but the price level and the volatility of silver do impact liquidity risk through a widespread phenomenon of “withdrawal-and-redeposit”. Individuals avoid the levy by temporarily withdrawing money until it is below the threshold by a small amount. So, low silver prices would imply that more individuals are above the threshold and therefore higher withdrawals can be expected. And since the threshold is announced only a few hours before the Zakat payment, more volatile silver prices would also increase deposit fluctuations.

Indeed, the authors found that bank branches in Sunni-majority cities exhibit a 5% average decline in deposits during Ramadan compared to other branches in different cities. They also found that banks exposed to higher volumes of Zakat-related withdrawal offer loans with a shorter maturity period (between 6% and 7% shorter) and that these loans are offered at lower lending rates (0.18-0.22 points lower). They are also around 14% lower in amount.

To test whether such credit reallocations toward the short-term translate into lower investments, the authors created a firm-level database of imports of capital and non-capital goods along with the bank that offered the trade credit used to finance imports. Using the import of capital goods as a proxy for long-term investment and non-capital goods as a proxy for a short-term investment, the authors found that a decline in long-term finance forces firms to reduce their import of capital goods by 27% - 30% and to a weaker extent the import of non-capital goods by 6% - 8%.

Their findings are especially useful in evaluating policies that encourage the inflow of bank deposits – and offer evidence to guide decision-making when faced with liquidity risk trade-offs. The results also make a case for better inter-bank markets and central bank facilities that could mitigate the impacts of the liquidity risk by allowing banks to smooth out their deposit shocks and uncertainties.

M Ali Choudhary, Nicola Limodio. “Liquidity Risk and Long-Term Finance: Evidence from a Natural Experiment.” The Review of Economic Studies, rdab065, DOI: https://doi.org/10.1093/restud/rdab065

by Sahana Subramanyam