Deferred Compensation May Be a Form of Insider Trading

RESEARCH BY FRANCESCA FRANCO AND OKTAY URCAN FINDS EVIDENCE THAT EQUITY DEFERRALS ARE SOMETIMES USED AS A SUBSTITUTE FOR OPEN MARKET PURCHASES NEAR QUARTERLY EARNINGS ANNOUNCEMENT DATESInsiders at public companies may use undisclosed information that can have an impact on share price (so-called Material Non-Public Information, MNPI) for personal enrichment. This behavior is defined as insider trading and is heavily punished by the U.S. Security Exchange Commission. However, insiders sometimes find loopholes within the law to continue to buy or sell securities.

According to U.S. federal securities law, specifically Rule 10b-5, insiders at public companies are prohibited from engaging in insider trading activities because of the breach of fiduciary duty that they have towards shareholders. This state of law might be further reinforced by the company’s insider-trading policies. Nonetheless, corporate officers and directors may engage in transactions that are exempt from company’s insider-trading memos and Rule 10b-5.

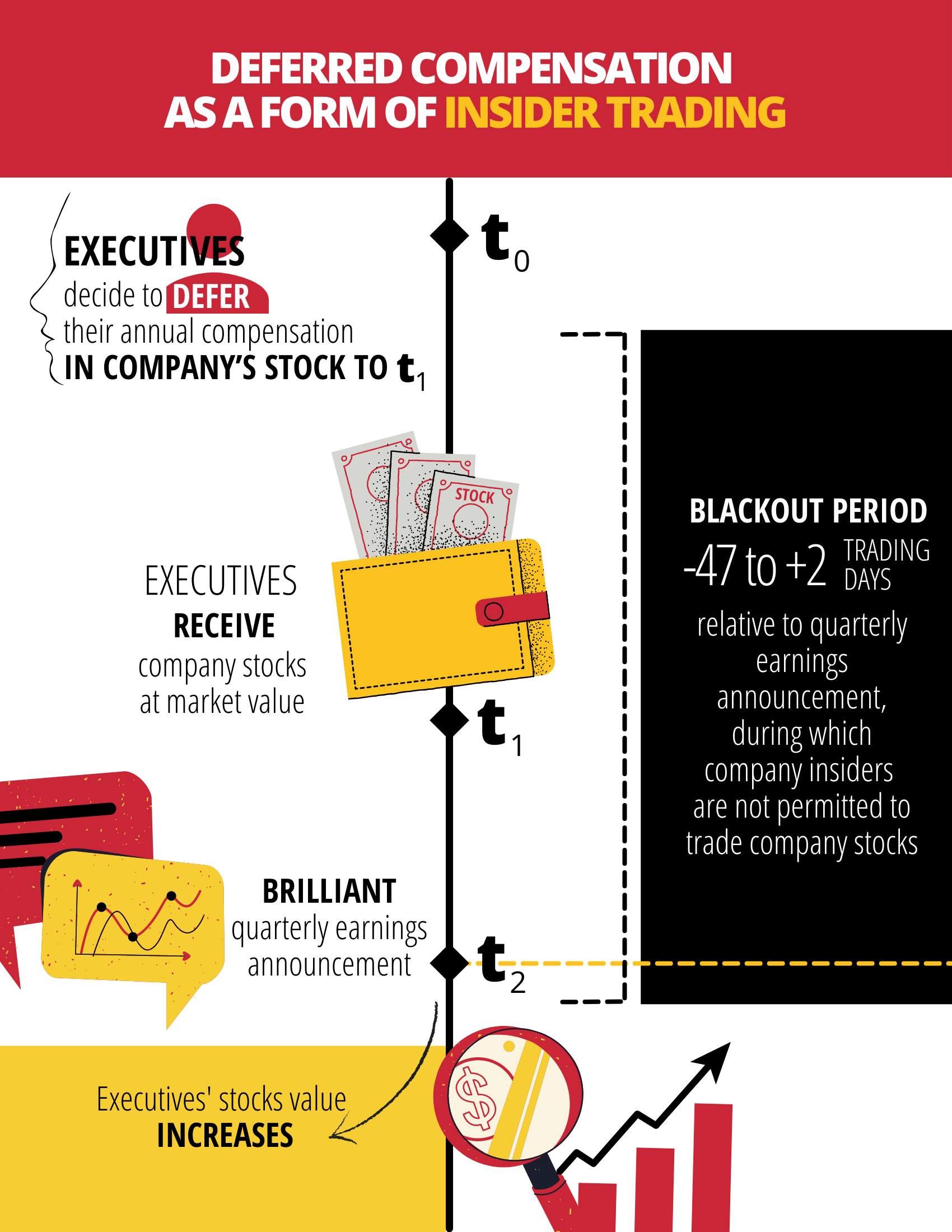

An interesting tool available to insiders is non-qualified deferred compensation plans, which are at the center of the forthcoming paper by Bocconi Professor Francesca Franco (Department of Accounting). When the executives decide to defer their annual cash compensation, they must agree with the firm - by the end of the calendar year prior to which the cash compensation will be earned - about the proportion of the compensation to be deferred, the notional investment choice, the deferral transaction dates, and the forms and time of distribution. The most common forms of investment alternatives include stock indexes, treasury note rates, and the company’s stock.

Infographics by Weiwei Chen

The option to defer cash payment in company stock allows executives to convert part or all of their annual base salary and other cash pay into the company’s deferred stock and this choice is deemed irrevocable.

Hence, as a consequence of the peculiarities embedded in equity deferral compensation plans, Professor Franco and her co-author Professor Oktay Urcan (University of Illinois at Urbana-Champaign) investigate whether executives use equity deferrals to acquire their firms’ stock when open-market purchase would violate Rule 10b-5, and whether executives profit from these transactions by adjusting the timing and content of corporate disclosures around their scheduled trades.

From a large sample of executive equity deferrals between 2000 and 2014, the paper provides sound evidence that executives use these transactions as substitutes for open-market purchases of the company’s stock. In particular, a significant fraction of the deferrals occurs during blackout windows (-47 to +2 trading days relative to quarterly earnings announcement dates, during which insiders are not permitted to trade company stocks).

Worth consideration is the evidence brought to light by Professors Franco and Professor Urcan that executives earn substantial abnormal returns from their deferrals, and this result is even stronger when transactions occur during blackout periods.

Lastly, executive deferred amounts are significantly associated with the trend of the news released around the deferral transaction date (the date stock are distributed), with the deferred amounts being significantly higher before the disclosure of good earnings news and lower before the release of the bad news. These results suggest that deferring executives profit from these transactions through the timing and the content of corporate disclosures near their scheduled deferral trades.

Francesca Franco, Oktay Urcan. “Executive Deferral Plans and Insider Trading.” Accepted article published online, Contemporary Accounting Research. DOI: https://doi.org/10.1111/1911-3846.12752.

by Giulia Sargiacomo