High Speed Internet Can Boost Credit in Developing Countries

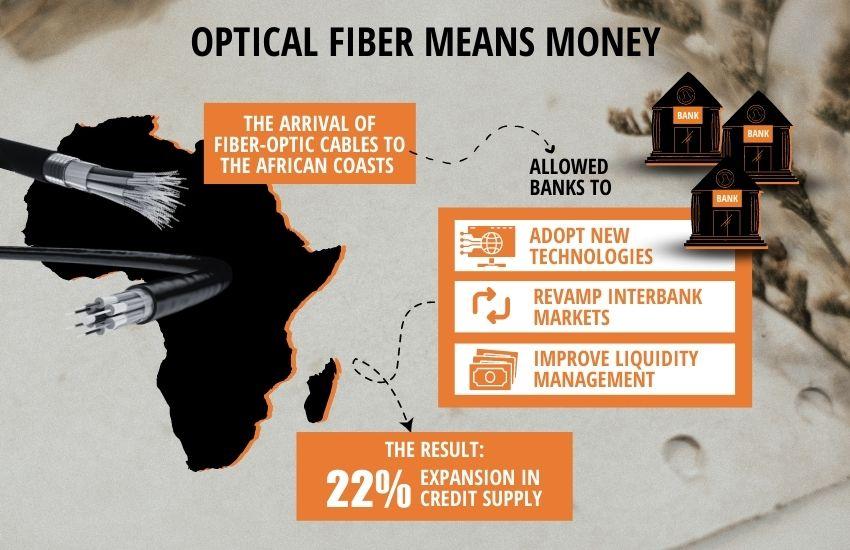

THE ARRIVAL OF FIBEROPTIC CABLES TO THE AFRICAN COASTS ALLOWED BANKS TO ADOPT NEW TECHNOLOGIES, THUS REVAMPING INTERBANK MARKETS AND IMPROVING LIQUIDITY MANAGEMENT. THE RESULT: A 22% EXPANSION IN CREDIT SUPPLYWhen, in the mid-2010s, Nicola Limodio was serving as a consultant to the World Bank in Ethiopia, he was appalled at the high cost and unreliability of satellite communications. “Lacking the high-speed internet connections that only fiber-optic cables can provide,” he said, “banks were forced to use the satellite even for mundane operations and many bankers deemed this as a damning constraint to their expansion.”

Now, in a paper forthcoming in Management Science with Angelo D’Andrea (Bank of Italy), Professor Limodio proved that high-speed internet promotes the role of banks and credit in Africa. They estimated that high-speed internet induced a 22% expansion in credit supply, thanks mainly to a wider adoption of a specific technology used in the interbank market, the real-time gross settlement system (RTGS). “When the interbank market works,” Professor Limodio summarizes, “banks keep less liquidity and lend more money.”

The observed effect was notably higher in countries with a weak pre-existing interbank market.

Infographic by Weiwei Chen

Fiber-optic submarine cables have been reaching the African coasts in a staggered fashion. The first countries to be connected, in 1994, were Morocco and Djibouti, and the deployment is still ongoing. This allowed authors to evaluate the effect of high-speed Internet, comparing the countries reached by the cable and those still without. Their database included 629 banks in 37 coastal countries.

Fiber-optic cables shattered high speed internet costs by 98% compared to satellite technology and turned out to be much more reliable. After the cable arrival, banks presented sizeable gains in lending and deposits, which increased by 36% and 25%, respectively. The authors estimated that 62% of the growth in lending (i.e. a 22% increase) was due to supply-related factors, while the rest was the result of an increase in demand, as firms exploited the improved connectivity to boost their own employment and business opportunities.

Data confirmed that, when the cable arrived, the probability of banks to adopt the RTGS significantly increased, and banks improved their liquidity management after the adoption: interbank loans and deposits grew by 30% and 63% respectively, and liquidity hoarding declined by 14 percentage points.

In a supplementary exercise, authors followed 32,761 African firms to show the real effects of high-speed internet. The results in this second part indicate that being connected to fast internet increases firm access to finance and loan maturity. This effect, together with an increase in sales and full-time employment, is particularly significant, again, in countries that had an underdeveloped interbank market before the cable’s arrival.

“Our analysis,” Prof. Limodio concluded, “confirms that promoting the size and speed of interbank markets can improve financial integration, risk sharing and ultimately credit and development. It also speaks to policymakers as it suggests that investments in new technologies can favor capital market integration and help the convergence of underdeveloped countries.”

Nicola Limodio, Angelo D’Andrea, “High-Speed Internet, Financial Technology and Banking,” forthcoming in Management Science. DOI: https://doi.org/10.1287/mnsc.2023.4703.

by Fabio Todesco