Why Family Businesses Passed the Pandemic Test

THE DECLINE IN SALES IN 2020 WAS SIMILAR TO NONFAMILY BUSINESSES, BUT THE RECOVERY IN 2021 WAS STRONGER, WITH NEARLY DOUBLE GROWTH RATES, ACCORDING TO DATA FROM THE 13TH AUB OBSERVATORY. THIS HAD NOT BEEN THE CASE IN 2009. RENEWED CAPITAL STRENGTH BOOSTED THE PERFORMANCEItalian family businesses have faced the pandemic crisis of 2020 better than they did the financial crisis of 2009, explains the XIII AUB Observatory. It is promoted by AIDAF (Italian Association of Family Businesses), AIDAF-EY Chair in strategic management in Family Business at Bocconi University, UniCredit and Cordusio, with the support of Borsa Italiana, Fondazione Angelini and the Chamber of Commerce of Milan Monza Brianza Lodi.

This year, the Observatory analyzed the financial statements of all 11,803 Italian family businesses with a turnover of more than 20 million euros, equal to 65.7% of Italian businesses of that size.

Soundness and resilience

“In 2020, family businesses suffered a fall in turnover similar to that of non-family businesses, while in 2009 they had suffered to a much greater extent,” said Guido Corbetta, holder of the AIDAF-EY Chair and co-author of the Observatory with Fabio Quarato. “Moreover, in the first half of 2021, listed family businesses demonstrated a recovery in revenues almost twice as high as non-family businesses (26.6% vs. 14.1%) and profitability three times as high (ROA 5.4% vs. 1.8%).”

The Observatory points to two reasons for the good performance of family businesses. On a contextual level, the 2020 crisis showed a V-shaped pattern, with a sharp decline in sales followed by a sharp rebound and equally strong growth. Family businesses, however, have had the merit of coming into the crisis with significantly better balance sheets than a decade earlier. In 2009, 30.9% of family businesses had critical balance sheet ratios, while in 2020 that was true of only 21.8%. Confirming this trend, in the two-year period 2020-2021, the incidence of family businesses that entered liquidation or insolvency proceedings was 1.7%, less than half the incidence in the two-year period 2009-2010, which was about 4%.

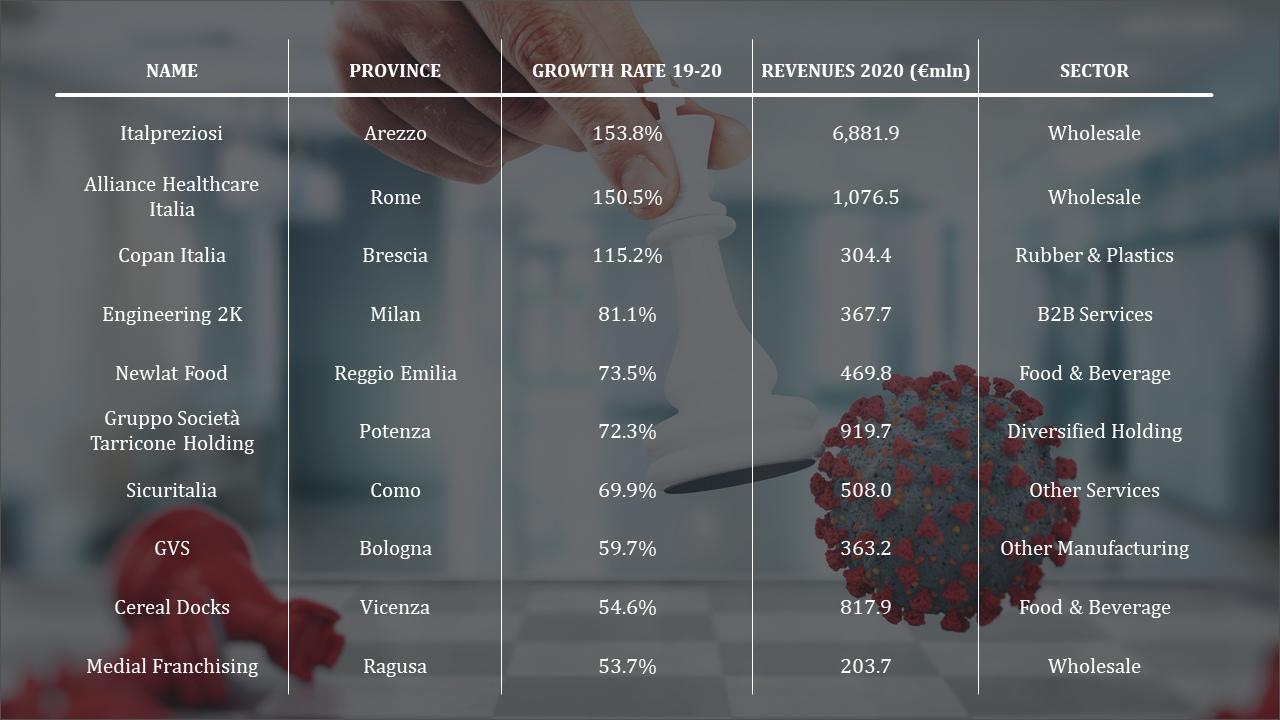

In a panorama that is less dark than might have been hypothesized one year ago, the Observatory identifies the family businesses that have achieved the strongest growth in revenues, among those with a turnover of more than €100mln.

Mixed signals

Mixed signals come from the analysis of the governance of family businesses. On the one hand, there is a growing openness to non-family leaders and board members, especially in relatively larger companies. In ten years, from 2010 to 2020, the incidence of family leaders fell by five points (from 81.7% to 76.5%) in companies between €20mln and €50mln in sales and by eight points (from 75.8% to 67.6%) in those over €50mln. Similarly, boards of directors made up only of family members fell from 50.7% to 44.8% among smaller companies and from 38.1% to 29.8% among larger ones.

The critical signal concerns the age of leaders and board members. The presence of under 40s among leaders has plummeted in 10 years: from 16.9% to 8.7% if the youngest leader of the top teams is considered, and even from 9% to 3.3% if the oldest one is considered. 73.1% of the boards of directors of the relatively smaller companies and 71.4% of the larger ones do not even include an under-40, a sharp deterioration from 52.9% and 54.1% in 2010. The gradual aging of family businesses is a bad sign, which becomes even worse at a time when the country is preparing to invest the resources of the National Recovery and Resilience Plan first and foremost in new technologies.

“In Italy, family businesses are a distinctive feature of the productive and economic fabric,” stresses Stefano Vecchi, Head of Wealth Management & Private Banking Italy UniCredit. “Italy’s rating has grown after 20 years, entrepreneurs who are our customers have shown a great ability to react after the pandemic, looking to the future with confidence. As UniCredit, we want to support this path of economic transformation and reform, both on the side of private investment and business support, with great attention to the next generation. In this sense, with our bankers and our specialists we offer customers a red carpet featuring services and products oriented to the management of sensitive issues such as family governance and generational succession, while maintaining a strong focus on sustainability.”

Francesco Casoli, President of AIDAF, says “Italian family businesses must be an active part of the change in a moment of great redefinition of the future of our country and the world, characterized by the upcoming investments and policies related to the PNRR. These are companies that, thanks to their distinctive characteristics, have shown they are able to withstand the most critical and complex period of the pandemic. And above all, they have shown that they are able to react, contributing to the national economic recovery with capital solidity, long-term vision and proactivity. These are all characteristics that are part of the DNA of Italian family businesses, which intend to play a key role in the economic recovery. They will also be key in defining the country's agenda, in order to bring attention to strategic issues, such as a greater presence of young people among leaders and on company boards.”

“Family businesses represent three quarters of listed companies in Italy and continue to be protagonists of the list also in the primary market with a share of 87% of the total number of companies listed in 2020-2021,” says Barbara Lunghi, Head of Equity Primary Markets, Borsa Italiana, Euronext Group. “Data from recent years and companies working towards listing in 2022 show us a growing number of family businesses, from SMEs to global leaders, that are looking to the stock market to accelerate growth, finance investments in innovation and internationalization, increase competitiveness, and maintain assets within the family wealth.”

“The AUB Observatory makes clear the value that a modern and structured corporate governance has for growth, even more so in a context of instability like the one we are operating in,” comments Sergio Marullo di Condojanni, CEO of Angelini Industries. “Within our industrial group, in recent years we have designed a new governance whose ambition is to combine together the best market practices and the long-term vision typical of family companies.”

by Fabio Todesco