When the Interests of Firms and Employees Diverge

GROHSJEAN AND PIEZUNKA ANALYZE THE CASE OF COMPETING COMPANIES COLLABORATING WITH THE SAME CORPORATE PARTNER: IT HURTS FIRM PERFORMANCE, BUT HELPS EMPLOYEES DEVELOP SOCIAL CAPITAL AND ADVANCE THEIR CAREERSRecent research by Thorsten Grohsjean (Bocconi Department of Management and Technology) and Henning Piezunka (INSEAD) showed that some collaborations can hurt firm performance but help employees' career.

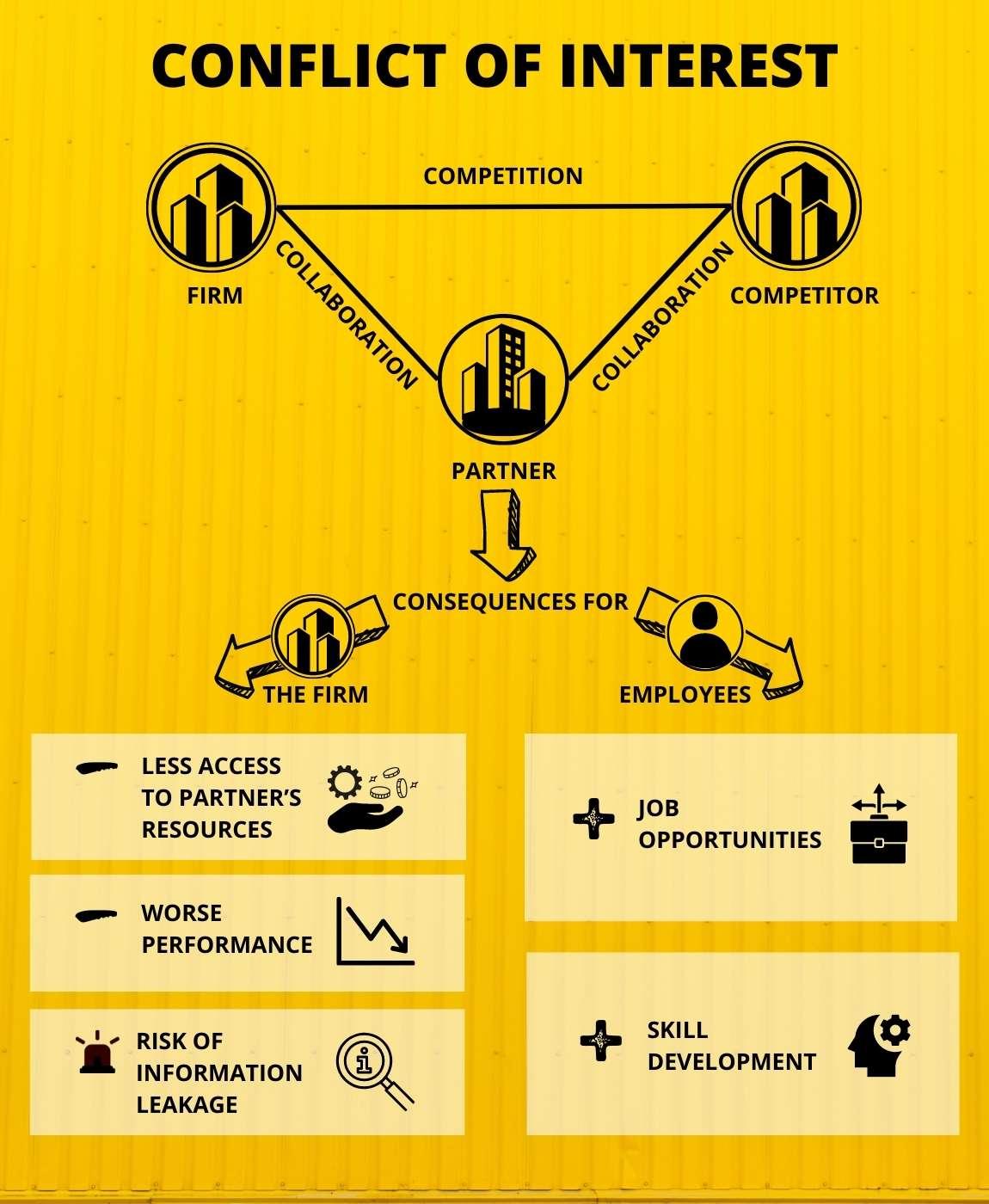

Firms collaborating with the same partner often compete for its resources, in a condition called peer competition. Peer competition reduces their access to the partner’s resources and hurts their performance. Employees, though, may favor this kind of collaboration, as it helps them develop social capital to advance their careers, as Grohsjean and Piezunka suggested in an article forthcoming in Strategic Management Journal.

Infographic by Weiwei Chen

Peer competition among firms collaborating with the same partner brings about negative outcomes for several reasons. First, firms may find it difficult to access their partner’s resources, especially when they compete with superior peer firms. “The number of peer firms is inversely proportional to the attention they can have because a partner's attention is limited,” Professor Grohsjean explained.

In addition, there is a risk of harmful information leakage. Granting the partner access to proprietary information is necessary for firms to get feedback from their partners. While firms may control how much information they share with the partner, they cannot control the leakage to peer firms to which the partner indirectly connects them. More fundamentally, peer firms are structurally equivalent as they compete for the partner's resources and potentially for the same consumers. Fierce competition and conflict are thus particularly likely in this situation.

Given the negative consequences of such peer competition for firms, Grohsjean and Piezunka conducted several interviews with employees in the video game industry where video game developers, who conceive and develop games, collaborate with video game publishers, who finance and market the games. They were surprised to learn that employees were well aware of the peer competition but were not bothered by it. “In fact, the employees often spoke enthusiastically about their peers,” Grohsjean said. “That’s why we decided to examine a seemingly counterintuitive hypothesis: peer competition may hurt the company but may benefit employees.”

The authors examined their hypothesis in the global video game industry. The empirical analysis supports the hypothesized divergent effects: sharing a partner with peer firms hinders the success of firms but benefits their employees.

“The collaboration with a shared partner gave employees the chance to overcome time, distance and social obstacles to connect with a potential employer,” Grohsjean explained. “Such interactions also provide employees with cover for forming otherwise frowned-upon relationships. For example, employees may claim—perhaps truly—to be on LinkedIn for their work, but they also make themselves known to headhunters and alternative employers.”

Specifically, the authors proposed two reasons why connections that employees develop with employees of peer firms can benefit them personally: job opportunities and skill development. “When an employer and potential employee already know each other, there is a greater likelihood of a match, and the match is likely to be of higher quality. In the meantime, the social connections formed with employees at other firms can help focal employees develop their skills,” Grohsjean comments. “This flexibility in employee career development may not be a bad thing for managers if we think about the flow of talent between firms. A better match between firm and employee is beneficial to firm performance in the long run.”

Henning Piezunka, Thorsten Grohsjean. “Collaborations That Hurt Firm Performance but Help Employees’ Careers.” In Strategic Management Journal, online before inclusion in an issue. DOI: https://doi.org/10.1002/smj.3447.

by Jenny Mao